Doctorate of Business Administration

Research Articles (89)

On current research topics in finance. 🚀 Kickstart your dissertation research - select an article and we will create and send you a research proposal on this topic

We’re excited to share those articles that not only shed light on the evolving landscape of the finance industry but also serve as inspiration for your research projects and your dissertation. As we offer a wealth of ideas to kickstart your dissertation research, stay tuned for more insights! Happy reading!

Article Links

Jamie Dimon: Betting JPMo... | China´s Electric Car Mir... | Anthropic Launches Claude... | Standard Chartered Become... | Wall Street, Meet Satoshi... | AI, Please Hold for a Hum... | UK’s FCA Launches "Supe... | Starling Unveils AI-Power... | Tether CEO Defends Skippi... | AI vs. AI: The New Battle... | Sam Altman’s World Netw... | The Rise of Crypto Banks ... | Global Trade at a Crossro... | Agentic AI in Finance: To... | Stablecoins Part 2: Globa... | Overcoming the Limitation... | Understanding Stablecoins... | North Korea Bybit Hack (0... | AI Insurance Shift (03/20... | How Europe has ruined its... | The Global Race for Techn... | DeepSeek AI buzz puts tec... | China’s Demographic Shi... | Adyen launches AI-powered... | Wall Street might cut 200... | Will quantum computing so... | The Future of Accounting ... | Deutsche Bank Embraces Et... | CFPB Takes on Major Banks... | AI in finance: how employ... | Citigroup deploys AI tool... | Kraken winds down NFT mar... | Tether exits Euro Stablec... | Stablecoins Reach $190 Bi... | Americans’ Credit Card ... | Rising Fraud Complaints a... | A major disruption caused... | Stripe Leverages AI to En... | 2 incredible Banking FinT... | The Top AI Startups Trans... | Wise to Power Cross-Borde... | Historic fine for crypto ... | Banking on AI: the potent... | First half of 2024 sees a... | Sony to launch crypto exc... | Capital Ones partnership ... | Synapses collapse exposes... | Credit Unions outpacing c... | Google Pay is getting 3 m... | SEC approves ether ETFs a... | PayPal expands PYUSD stab... | Visa preps for US pay-by-... | Tokyo firm adopts Bitcoin... | AI is eating banking: JPM... | Stablecoins surge, challe... | Key takeaways from Warren... | The Future of AI-Enhanced... | A turning point for DeFi ... | So, Bitcoin Halving Is Do... | Stripe to bring back cryp... | Deepfakes: the next front... | Hong Kong approves spot B... | Is AI a job killer in the... | The Billion-Dollar (FinTe... | AI is revolutionizing Ris... | Apples ReALM aims to revo... | SEC wins ruling allowing ... | Ripple joins stablecoin r... | The rise of embedded fina... | JPMorgan aims to revoluti... | ChatGPT buzz raises the b... | Klarna replaces 700 human... | Why is Blackrock entering... | Case-Study: how digital b... | 𝕏 gears up to offer pa... | 23 lessons for every FinT... | Will Open Banking eat Vis... | Generative AI will comple... | JPMorgan is leading the w... | JPMorgan is developing a ... | Tesla could become the mo... | Biometric payments is a $... | Visa expanded stablecoin ... | FinGPT, the first Open-So... | Visa creates $100M Genera... | Will NFTs Rewrite Finance... | Customer first, Banking s... | Overcoming the challenges... | Is Robo-Advisory already ... |

Jamie Dimon: Betting JPMorgan Will Win the AI Arms Race (31.07.2025)

Jamie Dimon has declared JPMorgan Chase is aiming to “win” the artificial intelligence arms race, positioning the bank to outperform both fintech disruptors and legacy finance rivals. Recognizing that proprietary data is a core competitive advantage, Dimon emphasizes leveraging JPMorgan’s trove of customer, transaction and risk‑profile datasets to power next‑generation AI tools. He has backed this ambition by investing billions and putting trusted executives in charge of execution

China´s Electric Car Miracle Turns Menace – State-Driven EV Boom Risks Economic Fallout (31.07.2025)

China’s electric vehicle sector once hailed as a cornerstone of China’s industrial transformation is now showing fatal signs of overreach state‑backed expansion has created a perfect storm of excess capacity collapsing margins and rising economic risk

Anthropic Launches Claude for Financial Services: A New Standard for AI-Powered Finance (16.07.2025)

Anthropic has officially launched Claude for Financial Services, a purpose-built version of its advanced AI platform tailored to meet the regulatory, data, and operational demands of banks, insurers, asset managers, and fintech firms. With integrations into leading financial data sources and early adoption from major institutions like NBIM, Bridgewater, and Commonwealth Bank, Claude aims to redefine productivity, compliance, and decision-making across the financial sector.

Standard Chartered Becomes First Major Bank to Launch Institutional Crypto Spot Trading (16.07.2025)

On July 15, 2025, Standard Chartered made history as the first global systemically important bank to offer deliverable spot trading of Bitcoin and Ether to institutional clients. The new service - integrated into its FX trading infrastructure - includes regulated custody options and will soon feature non-deliverable forwards, signaling a decisive shift in mainstream finance’s embrace of crypto.

Wall Street, Meet Satoshi(08.08.2025)

A silent revolution is unfolding in the heart of the financial sector. Once considered the domain of fringe technologists and crypto enthusiasts, Bitcoin and blockchain-based tokenization are now beginning to take root in mainstream financial institutions and strategies. As traditional finance grapples with macroeconomic volatility, institutional distrust, and the promise of decentralized technology, a shift toward digital assets is becoming increasingly evident. This article examines the integration of Bitcoin and tokenization technologies into classical finance and evaluates their economic, technological, and regulatory implications.

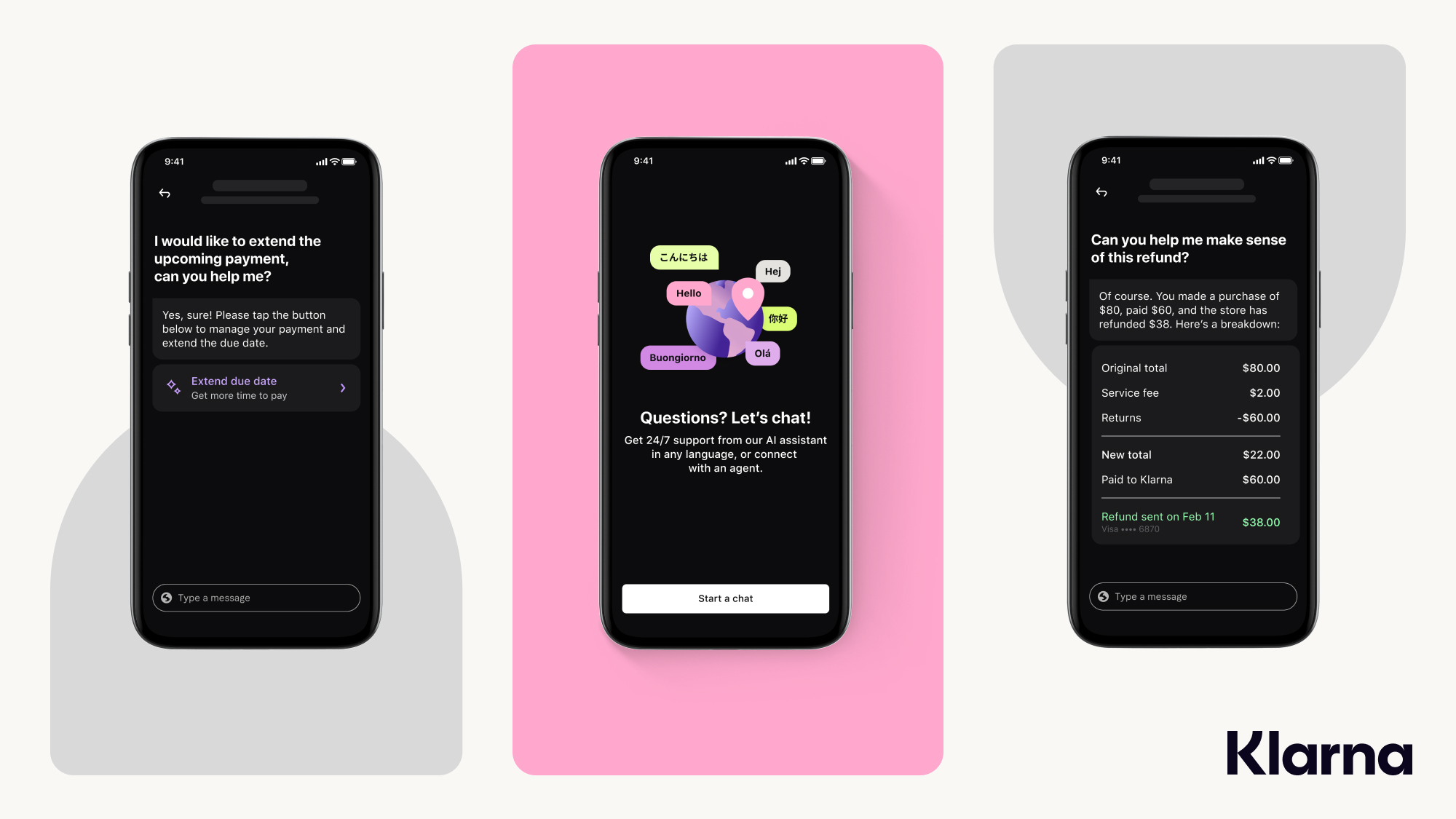

AI, Please Hold for a Human(08.08.2025)

In a striking reversal, Klarna has announced its return to human-powered customer support after a high-profile push toward AI-driven service fell short of expectations. What began as an ambitious automation strategy is now being tempered by a renewed emphasis on empathy, quality, and customer trust.

UK’s FCA Launches "Supercharged Sandbox" with Nvidia to Propel AI Innovation in Banking (13.06.2025)

In a major leap forward for AI adoption in finance, the UK’s Financial Conduct Authority (FCA) has teamed up with Nvidia to launch the "Supercharged Sandbox" — an initiative enabling banks and financial firms to safely prototype AI-driven solutions with state‑of‑the‑art GPU power and regulatory support. Starting in October, this collaboration sends a powerful message: the UK is ready to harness AI responsibly while accelerating its financial sector’s competitiveness.

Starling Unveils AI-Powered Spending Intelligence Tool to Help Brits Be “Good with Money” (12.06.2025)

Starling Bank has announced the launch of Spending Intelligence, a first-of-its-kind AI tool integrated directly into its banking app. Built using Google Cloud’s secure infrastructure and powered by Gemini AI, this new feature is part of Starling’s mission to help customers in the UK become “Good with money.” The launch sets a new benchmark for how artificial intelligence can deliver meaningful, accessible financial insights to everyday users.

Tether CEO Defends Skipping MiCA — But Should We Be Concerned?(15.05.2024)

In a move that has raised both eyebrows and questions across the crypto community, Tether CEO Paolo Ardoino has publicly defended the company´s decision not to register its flagship stablecoin, USDT, under the European Union’s new Markets in Crypto-Assets (MiCA) regulatory framework.

AI vs. AI: The New Battleground for Financial Fraud (15.05.20259)

As artificial intelligence reshapes the financial industry, it is becoming a powerful double-edged sword. On one side, fraudsters are exploiting AI to execute more convincing, large-scale scams. On the other, AI is proving to be a critical tool for identifying and stopping fraud faster and more accurately than ever before. The battle is now algorithm vs. Algorithm - and the stakes are rising.

Sam Altman’s World Network in Talks with Visa to Develop Stablecoin Wallet(24.05.2025)

OpenAI CEO Sam Altman’s cryptocurrency venture, World Network, is reportedly in discussions with payments giant Visa to develop a stablecoin-based payments wallet, according to sources familiar with the matter. The partnership could transform the firm’s World Wallet into a globally accessible, self-custodied financial tool—essentially a “mini bank account” for users transacting in digital and fiat currencies.

The Rise of Crypto Banks - Decentralization is the destination — but regulation might just be the road that gets us there (24.04.2025)

In a world built on the idea of decentralization, why are some of crypto’s biggest players acting like... banks? The financial landscape is undergoing a profound shift. Leading cryptocurrency companies are making bold moves into traditional banking, a development that could revolutionize our understanding of money, transactions, and financial infrastructure. Industry heavyweights like Coinbase, Circle, BitGo, and Paxos have formally applied for bank licenses or charters—ushering in what many are calling the dawn of the "Crypto Banking Era." While cryptocurrencies and blockchain technology were born to disrupt traditional finance, a growing number of crypto firms are now seeking US banking licenses. Those Companies are blending the disruptive ethos of crypto with the trusted framework of traditional banking. So what gives? Let’s dig into why crypto banks are headed toward regulation — and why that may not be such a bad thing.

Global Trade at a Crossroads: The Key Economic Indicators to Watch During a Trade War (08.04.2025)

In times of escalating trade tensions and protectionist policies, such as the growing trade war between global economic powerhouses, economists and investors alike turn to specific economic indicators to assess the health and direction of the global economy. While long-term consequences of trade conflicts take time to materialize, some data points offer near real-time insights into shifting economic conditions. This article explores the most critical indicators that serve as early warning systems for changes in global economic momentum caused by trade wars.

Agentic AI in Finance: Towards Autonomy, Innovation, and Inclusion (08.04.2025)

As generative AI (GenAI) reshapes industries, the financial sector is now setting its sights on the next frontier—Agentic AI. Unlike GenAI, which requires direct human input, Agentic AI empowers autonomous agents to reason, collaborate, and make decisions independently. This shift promises a future where financial systems are not only faster and smarter but also more human-like in their ability to adapt, personalize, and self-improve. In this article we explore how Agentic AI is poised to revolutionize financial services—from real-time trading and adaptive asset management to personalized financial coaching and micro-loans in underserved regions. Alongside these breakthroughs, however, lie challenges that require thoughtful regulation, human oversight, and collaborative governance.

Stablecoins Part 2: Global Policy and Regulation(04.08.2025)

Stablecoins are fast becoming a central feature of the digital economy, bridging the gap between traditional finance and decentralized systems. As their use cases evolve — from cross-border payments to DeFi and tokenized assets — stablecoins have drawn the attention of global regulators aiming to balance innovation with security, transparency, and financial integrity. Following our previous article on how stablecoins work, this second installment dives into the diverse regulatory approaches emerging across the world. From Europe’s MiCA to Singapore’s stablecoin framework, the global patchwork of policy is shaping the future of digital money.

Overcoming the Limitations of Digital Banking Challengers (24.03.2024)

Digital banking challengers have revolutionized the financial landscape, offering convenience, competitive pricing, and a seamless user experience. These fintech startups have successfully attracted millions of customers by simplifying financial transactions and eliminating the inefficiencies of traditional banks. However, one of the most significant criticisms they face is their lack of comprehensive banking services and regulatory oversight. While they excel in certain areas, many digital banks struggle to provide a full suite of financial products and operate under the same stringent regulatory frameworks as established financial institutions. Addressing these concerns is crucial for the long-term sustainability and trustworthiness of digital banks.Lets have a look on how some challengers achieve the transition from beeing a disruptive fintech to becoming a primary banking partner for their customers.

Understanding Stablecoins and their Mechanisms (24.03.2025)

Stablecoins have emerged as a dominant force in the cryptocurrency market, representing over two-thirds of recent cryptocurrency transaction volumes. Unlike their more volatile counterparts, stablecoins maintain a consistent, predictable value by being pegged 1:1 to less volatile assets such as fiat currencies or commodities. By solving the issue of crypto price volatility, stablecoins have unlocked new use cases beyond trading and speculation, appealing to a broad range of crypto users, both retail and institutional. As regulatory momentum surrounding cryptocurrency continues to gain headway, stablecoins are becoming a focal point in discussions examining the technologies shaping the future of finance

North Korea Bybit Hack (03/2025)

In one of the largest cryptocurrency heists in history, North Korean hackers have allegedly stolen $1.5 billion from the crypto exchange Bybit. This staggering breach raises serious concerns about the security measures in place at crypto exchanges and highlights the persistent threats posed by state-sponsored cybercriminals. As the dust settles, many are questioning whether Bybit can recover, what mistakes led to the breach, and how users can better protect themselves when trading on cryptocurrency platforms.

AI Insurance Shift (03/2025)

The commercial insurance sector, a multi-billion-dollar industry, has long been burdened by outdated processes and manual workflows. However, a major transformation is underway, driven by AI technologies specifically designed to address inefficiencies within insurance operations. These advancements are streamlining workflows, enhancing connectivity, and enabling brokers, wholesalers, and carriers to operate with unprecedented efficiency.

How Europe has ruined its tech industry – and with it its modern basis for prosperity (06.02.2025)

In recent decades, Europe’s technology sector has faced significant hurdles, leading to a decline in its global standing. Factors such as overregulation, insufficient venture capital, and a conservative approach to innovation have contributed to this downturn. This decline not only affects the tech industry but also poses a threat to Europe’s broader economic prosperity.

The Global Race for Technological Dominance: Europe vs. U.S. vs. China Now and in 10 Years (06.02.2025)

Innovation and technology are the driving forces behind economic growth and global influence. Research and Development (R&D) investment, artificial intelligence (AI), industrial production, and strategic policy initiatives shape the competitive landscape among the world’s major economies. The United States continues to lead in technological advancement, while China is making rapid strides with aggressive investments and state-driven initiatives. Meanwhile, Europe faces mounting challenges, striving to keep pace with its global counterparts. This article explores the latest trends in R&D, AI development, industrial competitiveness, and policy strategies, providing insights into the evolving dynamics of global technological leadership.

DeepSeek AI buzz puts tech stocks on track for $1 trillion wipeout (27.01.2025)

Marc Andreessen Warns Chinese ChatGPT Rival DeepSeek Marks ‘AI’s Sputnik Moment’. A breakthrough by Chinese artificial intelligence startup DeepSeek has sent shockwaves through global markets, triggering a $1 trillion sell-off in U.S. and European tech stocks. Investors are now questioning the lofty valuations of some of America’s largest tech giants as DeepSeek’s latest AI model, R1, challenges the narrative that China lags behind the West in innovation. Instead, it suggests China may be on the verge of surpassing the U.S. in the AI race, drawing comparisons to the USSR’s historic Sputnik achievement. DeepSeek’s reasoning model R1, released as a fully open-source tool last week, has not only shattered the myth that China can only replicate Western technology but also raised concerns about the future dominance of U.S. tech giants like Nvidia. The model’s capabilities have sparked a reevaluation of the massive investments in AI by companies such as Microsoft, Meta, and Alphabet, as well as the sustainability of their valuations.

China’s Demographic Shift: Will Cheap Production Move Abroad or Be Replaced by Robots? (27.01.205)

One supplier had a robot that brought the material from the warehouse to production. When speaking to the company’s works council about it, he said that at first he had a negative attitude towards the robot because they cut two warehouse employees after implementation, but then they hired two technicians so that someone is always there around the clock in case there is a malfunction. That put it into perspective a bit, he said. China’s demographic challenges, characterized by a shrinking workforce and a rapidly aging population, present a complex situation that could have profound economic and social impacts. Let’s explore whether cheap production is more likely to shift to other countries or if China will compensate for its demographic decline with robots.

Adyen launches AI-powered payment platform (13.01.2025)

The new product suite, called Adyen Uplift, uses machine learning algorithms to analyse payment data and automate decisions about transaction routing, fraud prevention and cost optimisation. The system draws on data from more than one trillion dollars worth of processed payments across Adyen’s global platform. Businesses constantly struggle to choose between conversion, eliminating fraud, and keeping minimum costs. Adyen’s Uplift is designed to optimise the full payments funnel with the use of AI, trained on the company’s global transaction dataset. Using risk-based intelligence and automated conversion optimisation, the tool aims to help businesses get the most out of payments. Moreover, Adyen claims that the new Uplift will focus on the power of AI to solve real-time payment optimisation which, in turn, will boost businesses’ efficiency and performance.

Wall Street might cut 200,000 jobs due to AI (13.01.2025)

It’s official: no industry is immune to the transformative power of artificial intelligence, and the financial services sector is no exception. AI is poised to revolutionize banking operations, potentially displacing a significant portion of the workforce. For centuries, humanity’s greatest innovations have not replaced humans but enhanced our capabilities. Automobiles extended our mobility; computers amplified creativity; and now, AI is elevating human intelligence to new heights. A recent Bloomberg Intelligence report estimates that AI could result in approximately 200,000 job cuts in global banks over the next three to five years. The most affected roles? Those in back-office, middle-office, and operational departments—areas dominated by routine, repetitive tasks. Jobs involving data analysis, financial trend assessments, and risk evaluations are particularly vulnerable, as AI systems excel in processing massive datasets and generating insights far faster than humans. However, this isn’t the end of the human workforce in finance—it’s a transformation

Will quantum computing soon make about 25% of Bitcoins ($500 billion) vulnerable to hacks? (05.01.2025)

The cryptocurrency community has been abuzz with speculation following Google’s unveiling of the Willow processor— a groundbreaking quantum computing chip with 105 qubits. Announced in December 2024, this processor achieved a "mindboggling" milestone in computational speed, and it may only be the start of further advancements.While this innovation is a significant achievement, it has raised concerns among cryptocurrency holders. The same technology that ensures the security of digital assets today could potentially become their greatest vulnerability in the future. Some Bitcoin holders worry this technological leap might jeopardize the security of their assets.This concern stems from the foundational principles of modern cryptography. Cryptocurrencies like Bitcoin and Ethereum rely on mathematical problems that are exceptionally difficult for traditional computers to solve (such as factoring large numbers). Quantum computers, however, could potentially solve these problems with far greater efficiency.

The Future of Accounting and Finance Jobs With AI (03.01.2025)

The rapid evolution of technology is transforming industries worldwide, and accounting and finance are no exception. Artificial Intelligence (AI), once a concept limited to science fiction, has become a practical and essential tool for modern businesses. By automating routine tasks and uncovering valuable insights, AI is empowering accountants and financial professionals to move beyond traditional roles and focus on strategic decision-making. In this new era, AI is more than a tool; it is a competitive advantage. From improving efficiency and accuracy to enhancing compliance and enabling real-time analytics, AI is revolutionizing how organizations manage their finances. As businesses navigate this transformation, understanding and adopting AI technology is no longer optional—it is crucial for staying ahead in a competitive market. This article explores how AI is reshaping the accounting and finance landscape, its key applications, benefits, challenges, and the steps organizations can take to integrate it successfully.

Deutsche Bank Embraces Ethereum Layer 2 As Part Of Global Blockchain Initiative (26.12.2024)

Deutsche Bank, Germany’s largest financial institution, is making a bold move into blockchain technology, developing its own layer-2 (L2) blockchain on Ethereum. With this shift, the bank aims to address compliance challenges and bridge the gap between decentralized public blockchains and the regulated financial sector, utilizing ZKsync technology. This initiative, known as Project Dama 2, is part of the Monetary Authority of Singapore’s (MAS) Project Guardian, which unites 24 financial institutions to explore blockchain-based asset tokenization.✨See how AI has the potential to enhance Banks adopting blockchain technology

CFPB Takes on Major Banks Over Zelle Fraud: What It Means for Digital Payments (26.12.2024)

The Consumer Financial Protection Bureau (CFPB) has filed a significant lawsuit against JPMorgan Chase, Bank of America, Wells Fargo, and Zelle’s operator, Early Warning Services. The lawsuit claims that these financial institutions failed to implement proper consumer protections on Zelle, a popular payment platform, leading to nearly $870 million in fraud-related losses since Zelle’s launch in 2017. The CFPB’s investigation found that consumers were often exposed to fraud, such as unauthorized transfers and account takeovers. While the banks and Zelle dispute the allegations, this legal action highlights concerns over the platform’s security measures. ✨See how AI has the potential to significantly improve this case and its outcomes in several ways, particularly in terms of preventing fraud, enhancing security, and ensuring better regulatory compliance.

AI in finance: how employees can shift their roles from being replaced by AI to being essential contributors (18.12.2024)

The use of AI to optimize work processes in financial services is transforming the industry, offering both significant opportunities and challenges. Companies like Klarna demonstrate how AI can enhance efficiency, reduce costs, and drive innovation. However, this shift also raises critical concerns about job displacement, regulatory compliance, and algorithmic fairness.

Citigroup deploys AI tools to boost employee productivity (12.12.2024)

After years of technological delays, Citigroup is now equipping its 140,000-person workforce with advanced AI tools to enhance document analysis and streamline navigation of internal policies. The bank has introduced a digital guide that simplifies navigation through complex HR, risk, compliance, and finance policies, and a document management tool that enables simultaneous summarization, comparison, and search functionalities. Deployed across key markets, these tools are supported by a multi-year collaboration with Google Cloud, leveraging the Vertex AI platform to modernize Citigroup’s technology infrastructure and integrate generative AI capabilities.

Kraken winds down NFT marketplace (12.12.2024)

Kraken, a leading cryptocurrency exchange, is shutting down its non-fungible token (NFT) marketplace, less than 18 months after its official launch. The platform will transition to withdrawal-only mode on November 27, 2024, with users given a three-month window to withdraw their NFTs. Kraken cited the need to reallocate resources toward new and undisclosed product initiatives as the primary reason for the closure.

Tether exits Euro Stablecoin market amid EU regulatory pressures (2024.12.03)

Tether’s decision to discontinue its euro-backed stablecoin, EURT, underscores the evolving dynamics of the European cryptocurrency market as it aligns with the EU’s regulatory ambitions. This move marks a significant moment, given Tether’s stature as the leading stablecoin issuer and its role in shaping global crypto markets.

Stablecoins Reach $190 Billion Market Cap, Transforming Global Transactions (2024.12.03)

The stablecoin market has reached $190 billion in market capitalization as of November 2024, experiencing a remarkable 46% growth this year. This milestone highlights the rapid adoption and evolving role of stablecoins in global finance.

Americans’ Credit Card Debt Hits $1.17 Trillion as Borrowing Costs Remain High(05.12.2024)

As inflation persists and interest rates remain elevated, credit card debt in the United States has reached unprecedented levels, painting a complex picture of the nation’s financial health. With balances rising, consumers are navigating a challenging economic landscape marked by the tension between robust spending and the mounting cost of borrowing.

Rising Fraud Complaints and Legal Challenges for UK Challenger Banks(05.12.2024)

The rise of challenger banks in the UK has reshaped the financial landscape, offering customers digital-first solutions and innovative banking experiences. However, this rapid growth has come with challenges, as these fintech giants grapple with increasing fraud complaints and legal scrutiny. Recent data from the Financial Ombudsman Service and high-profile lawsuits reveal vulnerabilities in their systems, raising questions about the balance between innovation and security. As customer trust becomes paramount, these banks must navigate a complex web of regulatory demands and the need for robust fraud prevention strategies.

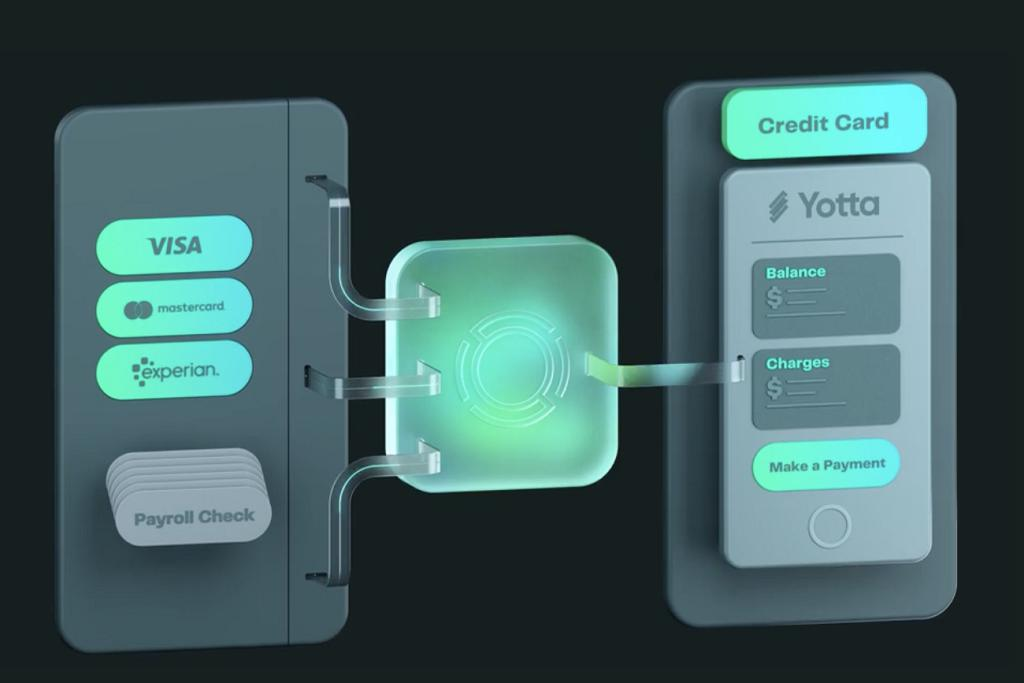

A major disruption caused by a Fintech Platform leads to Hundreds of Thousands of Frozen Accounts (28.11.2024)

The fintech platform Synapse, which abruptly froze hundreds of thousands of customer accounts across multiple partner financial institutions, caused a major disruption. Reliance on third-party fintech services for banking operations can lead to widespread financial chaos. The situation highlights the risks and regulatory challenges of outsourcing core banking functions to non-bank intermediaries.

Stripe Leverages AI to Enhance Cross-Border Commerce in Asia (28.11.2024)

Stripe has rolled out a suite of AI-powered tools to revolutionize how businesses handle payments, pricing, and fraud prevention. By incorporating artificial intelligence, Stripe aims to enhance operational efficiency and enable businesses to deliver a seamless and secure experience to their customers. These innovations are especially targeted at fostering growth in global markets, with a particular focus on Asia.

2 incredible Banking FinTech stories that were transforming the world of financial technology (11/2024)

Nubank has reached a significant milestone, acquiring 100 million customers in Brazil, representing over half of the countrys adult population. The company’s rapid growth highlights a shift in banking preferences, particularly among younger generations. Meanwhile, Revolut has expanded its crypto exchange across 30 European markets, offering low trading fees and advanced tools, marking a major step in its strategy to integrate traditional finance with cryptocurrency services. Both companies are reshaping financial landscapes in their respective regions.

The Top AI Startups Transforming Industries Globally (21.11.2024)

Leading AI startups are transforming industries across the globe. We explore how these startups are driving innovations in sectors such as healthcare, finance, transportation, and e-commerce. Those companies work in natural language processing, generative AI, edge computing AI chips, computer vision technologies, and machine learning solutions for enterprises. We examines the growing AI ecosystems iand highlight the role of accelerators in supporting these startups. These AI companies are not only reshaping industries but also contributing to the global AI landscape, with a strong emphasis on advancing AI in practical, real-world applications.

Wise to Power Cross-Border Payments for Standard Chartered (11/2024)

Standard Chartered has partnered with Wise, a leading cross-border payments fintech, to enhance its SC Remit service. Leveraging Wise Platform, Standard Chartered will offer low-cost, rapid international fund transfers across 21 currencies in Asia and the Middle East. This collaboration reflects broader trends in the financial sector as institutions adapt to growing demand for faster, transparent global payment solutions.

Historic fine for crypto firm underscores challenges in enforcing sanctions (11/2024)

Lithuanias Financial Crimes Investigation Service imposed a historic €9.3 million fine on Payeer for violating international sanctions and AML rules. Payeer facilitated transactions through EU-sanctioned Russian banks and failed to verify customer identities, generating €164 million in revenue over 18 months. This case signals increased regulatory scrutiny, a push for stricter compliance measures, and calls for international collaboration to prevent jurisdictional arbitrage. The case underscores the crypto industry’s need to prioritize regulatory adherence amid growing enforcement actions.

Banking on AI: the potential and pitfalls of Artificial Intelligence in Finance (11/2024)

As artificial intelligence revolutionizes the banking sector, industry leaders from UBS and McKinsey highlighted the potential and challenges facing financial institutions. Concerns range from return on tech investments to the future role of human bankers in an AI-driven landscape.

First half of 2024 sees alarming surge in digital currency thefts (11/2024)

The latest numbers show twice as much money has been stolen in crypto hacks and exploits in the first half of 2024 compared to the same period in 2023

Sony to launch crypto exchange (11/2024)

Japanese technology giant Sony is making a significant move into the cryptocurrency market with the launch of its new crypto exchange, S.BLOX. This development comes after Sonys acquisition of Amber Japan, formerly known as DeCurret, in August 2023 through its subsidiary Quetta Web.

Capital Ones partnership with FinTech giants (10/2024)

Financial services giant Capital One has formed a strategic alliance with payment titans Stripe and Adyen to combat the ever-growing threat of e-commerce fraud.

Synapses collapse exposes risks in FinTechs Banking-as-a-Service model (10/2024)

The bankruptcy of FinTech middleman Synapse Financial Technologies has exposed significant vulnerabilities in the popular Banking-as-a-service (BaaS) model, leaving thousands of customers unable to access their funds.

Credit Unions outpacing community banks in AI chatbot adoption (08/2024)

A recent study by Cornerstone Advisors has revealed that credit unions in the United States are moving more aggressively than community banks in their plans to adopt AI-powered chatbots in 2024.

Google Pay is getting 3 major upgrades to make payments easier and safer (08/2024)

Google Pay is about to get three new features designed to improve the online payment experience. And those concerned about the impending shutdown of the Google Pay app in the U.S. needn’t worry. This is an update for the Google Pay payment system, which is very much sticking around for the long haul.These three updates include the ability to see certain credit card benefits during checkout, a buy-now-pay-later option and an update to autofill that lets users verify card details with their device’s PIN number or biometric authentication.

SEC approves ether ETFs as crypto moves closer to mainstream (08/2024)

The US Securities and Exchange Commission has approved the first spot ethereum exchange traded funds, another landmark for cryptocurrency advocates and investors following the debut of bitcoin ETFs earlier this year.

PayPal expands PYUSD stablecoin to Solana, signaling growing adoption of digital assets (08/2024)

Finance behemoth PayPal has expanded its stablecoin, PayPal USD (PYUSD), to the Solana blockchain.

Visa preps for US pay-by-bank services (08/2024)

A spokesperson for Visa didn’t immediately respond to a question about when the card network’s pay-by-bank services would start in the U.S. While Visa’s business has long turned on its card services, the San Francisco-based company is increasingly branching out to offer other types of money transfer services, seeking to complement its credit, debit and prepaid card offerings.

Tokyo firm adopts Bitcoin as reserve asset amid Japans economic woes (08/2024)

Metaplanet Inc., a Tokyo-listed investment and consulting firm, has announced its adoption of Bitcoin as a strategic reserve asset in response to Japans persistent economic challenges.

AI is eating banking: JPMorgan unveils IndexGPT (07/2024)

Harnessing the power of artificial intelligence, banking giant JPMorgan Chase has just unveiled IndexGPT, a tool designed to revolutionize thematic investing.

Stablecoins surge, challenging traditional payment giants (07/2024)

Stablecoins, the less volatile cousins of cryptocurrencies, are experiencing a renaissance in real-time payments, with transaction volumes hitting record highs and surpassing those of traditional payment providers like Visa.

Key takeaways from Warren Buffetts annual letter (06/2024)

Earlier in April, Warren Buffetts favorite CEO letter came out - J.P. Morgan Chairman & Chief Executive Officer Jamie Dimon published his annual letter to shareholders.

The Future of AI-Enhanced Customer Acquisition in Banking (06/2024)

The future of AI-enhanced customer acquisition in banking holds immense potential for transforming the industry. With advancements in artificial intelligence, banking institutions have the opportunity to revolutionize their customer acquisition strategies and drive unprecedented growth.

A turning point for DeFi regulation? Uniswap faces potential SEC lawsuit (06/2024)

Uniswap, the largest decentralized cryptocurrency exchange (DEX), recently received a Wells notice from the U.S. Securities and Exchange Commission (SEC), indicating the regulators intention to sue the company.This development marks a significant moment for the decentralized finance (DeFi) space, as it could set a precedent for how DeFi platforms are regulated in the future.

So, Bitcoin Halving Is Done. What Happened and Whats Next? (06/2024)

In April 2024, the block reward was reduced to 3.125 bitcoin, which is worth around $200,122 as of April 19. However, since bitcoin mining typically requires expensive hardware and a vast amount of energy, it can be an expensive endeavor.

Stripe to bring back crypto with USDC stablecoin payments (06/2024)

Co-founder John Collison says crypto is ‘back’ a month after bitcoin reached a record high, as the fintech giant attempts to woo more customers across its services.

Deepfakes: the next frontier of financial fraud (05/2024)

The fight against fraud has met a formidable opponent in AI, which is responsible for the increasing sophistication of deepfake technology and its many implications for wrongdoing and abuse. With deepfake technology evolving so quickly, how can identity verification programs keep up?

Hong Kong approves spot Bitcoin and Ethereum ETFs, positioning itself as a crypto hub (05/2024)

Hong Kong has approved the first batch of spot Bitcoin and Ether exchange-traded funds (ETFs). This development comes as part of the citys drive to establish itself as a leading hub for digital assets.

Is AI a job killer in the finance industry? (05/2024)

Why >70% of FinServ execs expect AI to take their jobs

The Billion-Dollar (FinTech) Marketer: lessons from Ryan Reynolds (05/2024)

Ryan Reynolds-backed FinTech giant Nuvei just got sold to Advent International for a whopping $6.3 billion. This makes it the second-largest private equity deal in FinTech in recent memory. The biggest one is GTCR acquiring Worldpay for $11.4B. But more importantly, this makes Reynolds the greatest marketer alive today. Heres how he does it.

AI is revolutionizing Risk Management and Compliance in the banking sector (05/2024)

In the coming years, artificial intelligence has the potential to completely transform how financial institutions manage risks, automate, accelerate, and enhance a wide range of activities, from compliance to risk monitoring.

Apples ReALM aims to revolutionize voice assistants for smarter finance and beyond (05/2024)

In the coming years, artificial intelligence has the potential to completely transform how financial institutions manage risks, automate, accelerate, and enhance a wide range of activities, from compliance to risk monitoring.

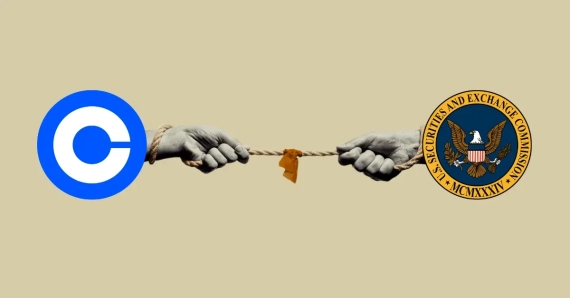

SEC wins ruling allowing a lawsuit against Coinbase (05/2024)

A federal judge has dealt a significant blow to Coinbase, ruling that the U.S. Securities and Exchange Commission (SEC) can proceed with its lawsuit accusing the cryptocurrency exchange of operating as an unregistered broker, exchange, and clearing agency.

Ripple joins stablecoin rush with plans for USD-pegged token (05/2024)

Crypto and blockchain giant Ripple has announced plans to launch its own dollar-pegged stablecoin later this year. The move comes as the stablecoin market, currently worth around $150 billion, continues to grow, with projections suggesting it could reach $2.8 trillion by 2028.

The rise of embedded finance (05/2024)

Financial services are the lifeblood of the economy, moving beyond old fashion products and moving towards customized products. Its a coming-of-age for embedded financing. Embedded finance is a multi-trillion dollar opportunity. Embedded finance can unlock an opportunity bigger than the current value of all fintech startups and the top global banks and insurers, combined

JPMorgan aims to revolutionize retail checkout with biometric pPayments (04/2024)

JPMorgan Chase, the largest US bank, is on a quest to make a significant leap in the payments industry by broadly launching biometric checkout services for its merchant clients in early 2025.

ChatGPT buzz raises the bar for banking chatbot capabilities (04/2024)

In recent years, banking chatbots and virtual assistants have seen a significant uptick in usage, with consumers increasingly interacting with these AI-powered tools for their financial needs. As generative AI (genAI) technologies like ChatGPT and Google Gemini gain prominence, customer expectations for these banking assistants are evolving, pushing banks to enhance their digital offerings.

Klarna replaces 700 human agents with ChatGPT as it prepares for a $20 billion IPO (04/2024)

The Swedish FinTech behemoth Klarna, renowned for pioneering the Buy Now, Pay Later (BNPL) model, is gearing up for a potential $20 billion US initial public offering (IPO) slated for as early as the third quarter of 2024. This move follows a tumultuous period for the BNPL firm, which seeks to transcend internal conflicts among stakeholders and a significant downturn in its valuation.

Why is Blackrock entering Crypto? A HUGE deal that shouldn’t be disregarded (04/2024)

BlackRock, the worlds largest money manager, reported record assets under management of a whopping $10.5 trillion and a 36% year-on-year increase in net income to $1.57 billion.

Case-Study: how digital bank Monzo reaches 9 million customer milestone (03/2024)

Digital bank Monzo has just crossed the landmark of 9 million personal UK current account customers, cementing its position as the countrys largest challenger bank. Two million customers joined just last year, with growth largely attributed to word-of-mouth.

𝕏 gears up to offer payments and banking services (03/2024)

Elon Musk grand vision for X is coming closer to reality as the platform secures more money transmitter licenses across US states. With the latest approval from Pennsylvania, X now has the green light to facilitate money transfers in 13 states so far.

23 lessons for every FinTech & AI startup that will teach you more about business and entrepreneurship than any MBA (03/2024)

Jeff Bezos is one of the most successful entrepreneurs of all time. He took Amazon from zero to a $1 trillion company in 23 years. He documented his journey in his annual letters to shareholders. Here we present you 23 lessons for every FinTech & AI startup that will teach you more about business and entrepreneurship than any MBA

Will Open Banking eat Visa’s and Mastercard’s lunch? (02/2024)

If you’re following the space actively, you know that financial technology companies have succeeded in reducing payment costs for merchants by providing cheaper and easier ways to accept payments.

Generative AI will completely transform FinTech and Banking over the next years (01/2024)

The financial technology industry is constantly evolving and throughout the years it has definitely changed the world and the way we interact with banks, consume, spend our money, and do business. 2023 and 2024 have undoubtedly been year like no others. They where the years of artificial intelligence and AI-powered innovation.

JPMorgan is leading the way in the adoption of AI in banking (01/2024)

JPMorgan is leading the way in the adoption of AI in banking. A new index that tracks banks implementation of AI puts banking behemoth JPMorgan at the top of the list, according to TechCrunch.

JPMorgan is developing a ChatGPT-like AI service for investors (01/2024)

JPMorgan, one of the biggest and most powerful banks in the world, is developing a ChatGPT-like artificial intelligence service for investors called IndexGPT

Tesla could become the most powerful AI company in the world disrupting Finance & FinTech forever (01/2024)

Tesla could soon be the most powerful AI company in the world - 90% of people might not realize this but Tesla is a FinTech. And now this unconventional FinTech is developing its own Supercomputer called Dojo that would not only be a significant catalyst for the automaker.

Biometric payments is a $6 trillion opportunity (01/2024)

JPMorgan will conduct a pilot of biometric payment technology that enables shoppers to pay by scanning their palms or faces at select US retailers. The initial test will take place at brick-and-mortar stores in the US, with the possibility of extending to the Miami Formula 1 Grand Prix. If the trial is successful, the technology will be extended to more US merchants by 2024.

Visa expanded stablecoin settlement capabilities (01/2024)

Financial technology powerhouse Visa is expanding its stablecoin settlement capabilities to the Solana blockchain and is also working with merchant acquirers Worldpay and Nuvei.

FinGPT, the first Open-Source Financial LLM (01/2024)

Meet FinGPT, an open-source financial large language model (LLMs) that aims to democratize Internet-Scale financial data, providing researchers and practitioners with accessible resources to develop FinLLMs and build the future of finance. Which is open.

Visa creates $100M Generative AI Venture Fund (12/2023)

Financial behemoth Visa announced a $100 million investment initiative to fund companies developing generative AI technologies for commerce and payments. This move signals Visas confidence in generative AIs potential to transform financial services.

Will NFTs Rewrite Finance As We Know It? (10/2023)

Twitters Founder, Jack Dorsey, sold his first-ever tweet – “just setting up my twttr”– as an NFT for USD 2.9 million on 22nd March 2021. The buyer, Mr. Sina Estavi from Malaysia, is a chief executive of a crypto firm, Bridge Oracle. He says: “It’s a piece of human history in the form of a digital asset. Who knows what will be the price of the first tweet of human history 50 years from now.”

Customer first, Banking second (09/2023)

Robo-advisors for the everyday investor began popping up around 2008, the year after the iPhone made its public debut. Just over a decade later, robo-advisors were managing about $785 billion, according to Backend Benchmarking, which specializes in research on digital advisors. Dozens of firms have built their own models to capitalize on popularity and an ascendant digital culture. Explore in this article how robo-advisors automate investing by using an algorithm to generate portfolios and understand the risks and benefits.

Overcoming the challenges of sustainable investing (08/2023)

Sustainable investing has come a long way and is now mainstream. Whatever your motivation for change, its clear there is an increased interest in sustainable investment – at times led by clients, led by firms themselves, and sometimes in response to regulation. This report provides an overview of concepts to shed light on both the progress and challenges with respect to the current state of ESG investing.

Is Robo-Advisory already meeting expectations in digital banking? (07/2023)

Robo-advisors for the everyday investor began popping up around 2008, the year after the iPhone made its public debut. Just over a decade later, robo-advisors were managing about $785 billion, according to Backend Benchmarking, which specializes in research on digital advisors. Dozens of firms have built their own models to capitalize on popularity and an ascendant digital culture. Explore in this article how robo-advisors automate investing by using an algorithm to generate portfolios and understand the risks and benefits.