Global Trade at a Crossroads: The Key Economic Indicators to Watch During a Trade War (08.04.2025)

In times of escalating trade tensions and protectionist policies, such as the growing trade war between global economic powerhouses, economists and investors alike turn to specific economic indicators to assess the health and direction of the global economy. While long-term consequences of trade conflicts take time to materialize, some data points offer near real-time insights into shifting economic conditions. This article explores the most critical indicators that serve as early warning systems for changes in global economic momentum caused by trade wars.

✨Get a Dissertation Research Proposal on this Topic

Fill in the form and we will shortly create and send you the research proposal on "Global Trade at a Crossroads: The Key Economic Indicators to Watch During a Trade War " for free.

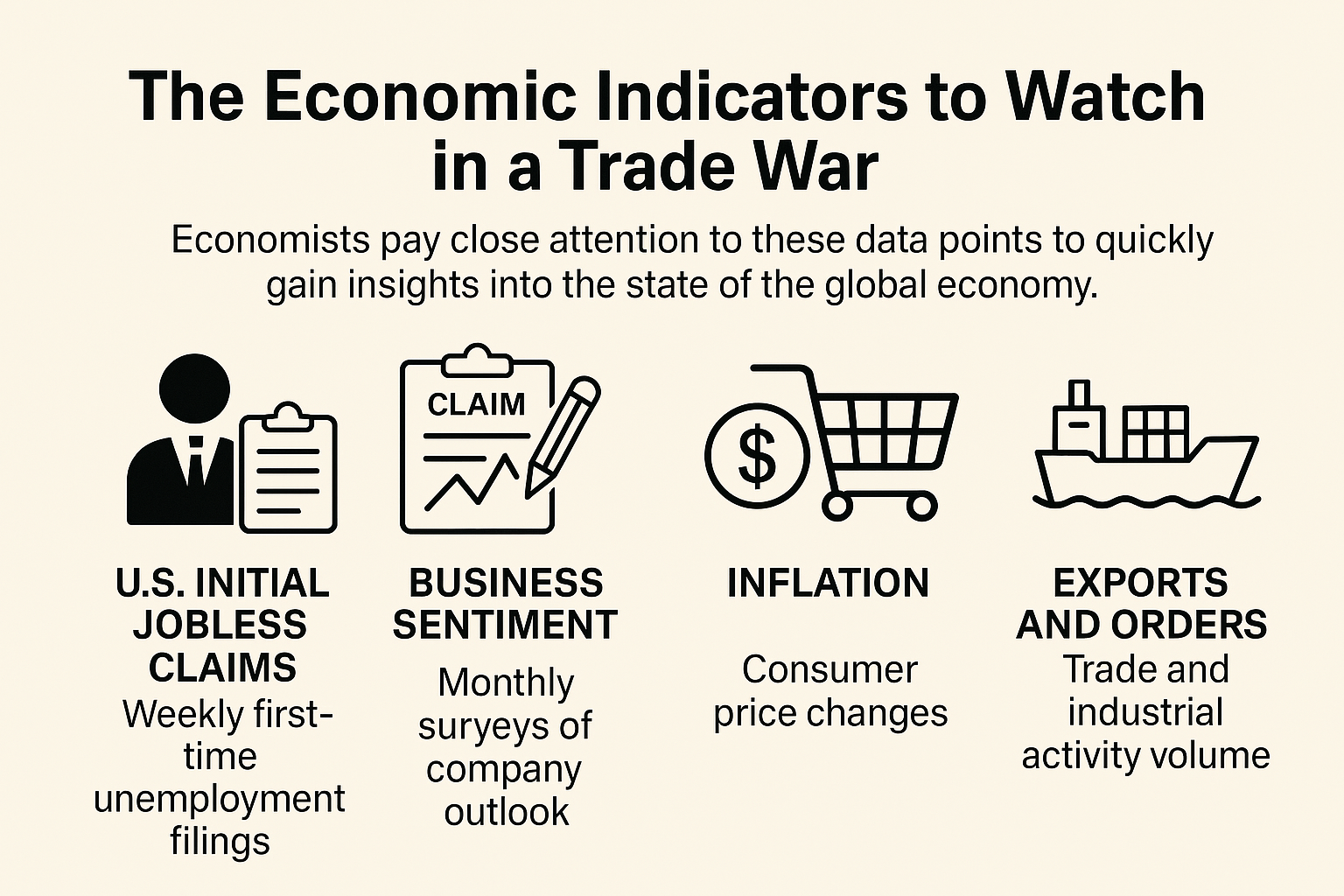

Economists pay close attention to these data points to quickly gain insights into the state of the global economy.

1. U.S. Initial Jobless Claims – A Real-Time Labor Market Thermometer

Among the fastest and most closely watched indicators in a trade war are the Initial Jobless Claims in the United States. These weekly figures reveal how many people filed for unemployment benefits for the first time, offering an early glimpse into labor market stress.

Why it matters? When tariffs and trade barriers impact manufacturing and exports, companies may respond by cutting jobs. A sustained increase in jobless claims—especially above the critical threshold of 270,000 per week—could suggest a turning point in the labor market and weakening business confidence.

During the COVID-19 pandemic, this indicator proved invaluable in detecting early labor market disruptions, and it continues to serve as a frontline signal in times of global economic stress.

2. Global Business Sentiment: PMI and Ifo Indices

Monthly business sentiment surveys are another crucial tool. Purchasing Managers’ Indices (PMIs), such as those published by S&P Global, and region-specific indices like Germany´s Ifo Business Climate Index, gather direct input from companies on orders, pricing, supply chains, and hiring intentions. Why it matters? These surveys detect trade-induced economic shifts before they appear in hard data. PMIs reflect a company’s forward-looking views and can quickly capture the impact of tariffs, supply disruptions, or increased costs.

Because they’re released monthly—and often ahead of official statistics—PMIs act as a vital leading indicator of global economic momentum, especially across the U.S., China, and the eurozone.

3. Inflation: A Barometer of Cost Pressures and Consumer Health

Inflation data, especially Consumer Price Index (CPI) reports, provide clues about the effects of trade conflicts on consumer prices.

Why it matters? Trade wars often trigger cost inflation through tariffs on imported goods. If companies pass these costs on to consumers, inflation could spike, affecting purchasing power and central bank policy. On the other hand, persistent low inflation despite trade conflict might point to weakened demand or price absorption by businesses.

Central banks watch inflation closely to adjust interest rates. Thus, rising prices linked to trade policy can influence broader monetary policy decisions.

4. Export and Industrial Order Volumes: Trade Flow Reality Check

Export and industrial order data provide a more granular view of how global trade patterns evolve during a conflict. Though less timely, they offer concrete proof of whether companies are losing or rerouting demand.

Why it matters? These figures show whether trade wars are reducing global shipments, shifting supply chains, or delaying orders. A decline in export volumes or foreign industrial orders can confirm that trade disruptions are taking a toll.

For instance, Germany’s foreign trade figures for April won’t be available until June 6, illustrating the delayed nature of this data. However, when available, they help paint a fuller picture of trade war impacts on industrial economies.

Summary: Reading the Trade War´s Economic Pulse

As geopolitical tensions reshape global commerce, economists turn to fast, responsive indicators to assess the fallout. Weekly U.S. jobless claims, monthly business sentiment surveys (like PMIs and Ifo), consumer inflation data, and export statistics together form a comprehensive dashboard for tracking the trade war’s economic effects.

Understanding these metrics is essential for investors, policymakers, and businesses navigating uncertainty. Trade wars can quietly erode growth or rapidly destabilize economies. The earlier these shifts are detected, the more effectively governments and markets can respond.

In an interconnected world, watching the right data at the right time is more important than ever.

About ECEBiS

At ECEBiS you are going to understand what will change the trajectory of the financial industry. You will develop a transversal view on the forces that are shaping the future financial industry.

From payments and lending to investment and money management, tech providers are actively shaping the future of the financial landscape - even pushing the boundaries of currency itself. You might evaluate the impact of robo-advising on health management and examine portfolio recommendations from a diversified set of RAs and attempt to identify the factors behind proposed splits between asset classes.

ECEBiS is a platform in academic research on new business models and innovative products. We investigate in fast moving sectors that are reshaping the financial world of tomorrow and pioneering new ways of doing business. We want to attract outstanding ECEBiS students in finance with experiences and exposures, who intend to

Doctorate of Business Administration (DBA) in Finance (online, 3 years part-time)

develop knowledge on challenges that shape the future of financial industry

engage with a program that offers the convenience of online learning with the benefits of accreditation and global reach.

raise awareness on the importance of fintech and sustainability in finance

identify the best practices in the financial industry to spread positive changes

Go beyond the virtual classroom and network with other ambitious executives and entrepreneurs as you expand your credibility and expertise in the world’s most transformative fields.