Klarna replaces 700 human agents with ChatGPT as it prepares for a $20 billion IPO (04/2024)

The Swedish FinTech behemoth Klarna, renowned for pioneering the Buy Now, Pay Later (BNPL) model, is gearing up for a potential $20 billion US initial public offering (IPO) slated for as early as the third quarter of 2024. This move follows a tumultuous period for the BNPL firm, which seeks to transcend internal conflicts among stakeholders and a significant downturn in its valuation.

✨Get a Dissertation Research Proposal on this Topic

Fill in the form and we will shortly create and send you the research proposal on "Klarna replaces 700 human agents with ChatGPT as it prepares for a $20 billion IPO " for free.

With its sights set on the horizon, Klarna is harnessing the power of AI to orchestrate what could be the most significant IPO of 2024.

In 2021, Klarna soared to a pinnacle valuation of $45.6 billion, clinching the title of Europes most valuable startup. However, the tide turned swiftly as escalating interest rates prompted investors to retreat from lending platforms, precipitating a drastic decline in Klarnas valuation to $6.5 billion within a mere year.

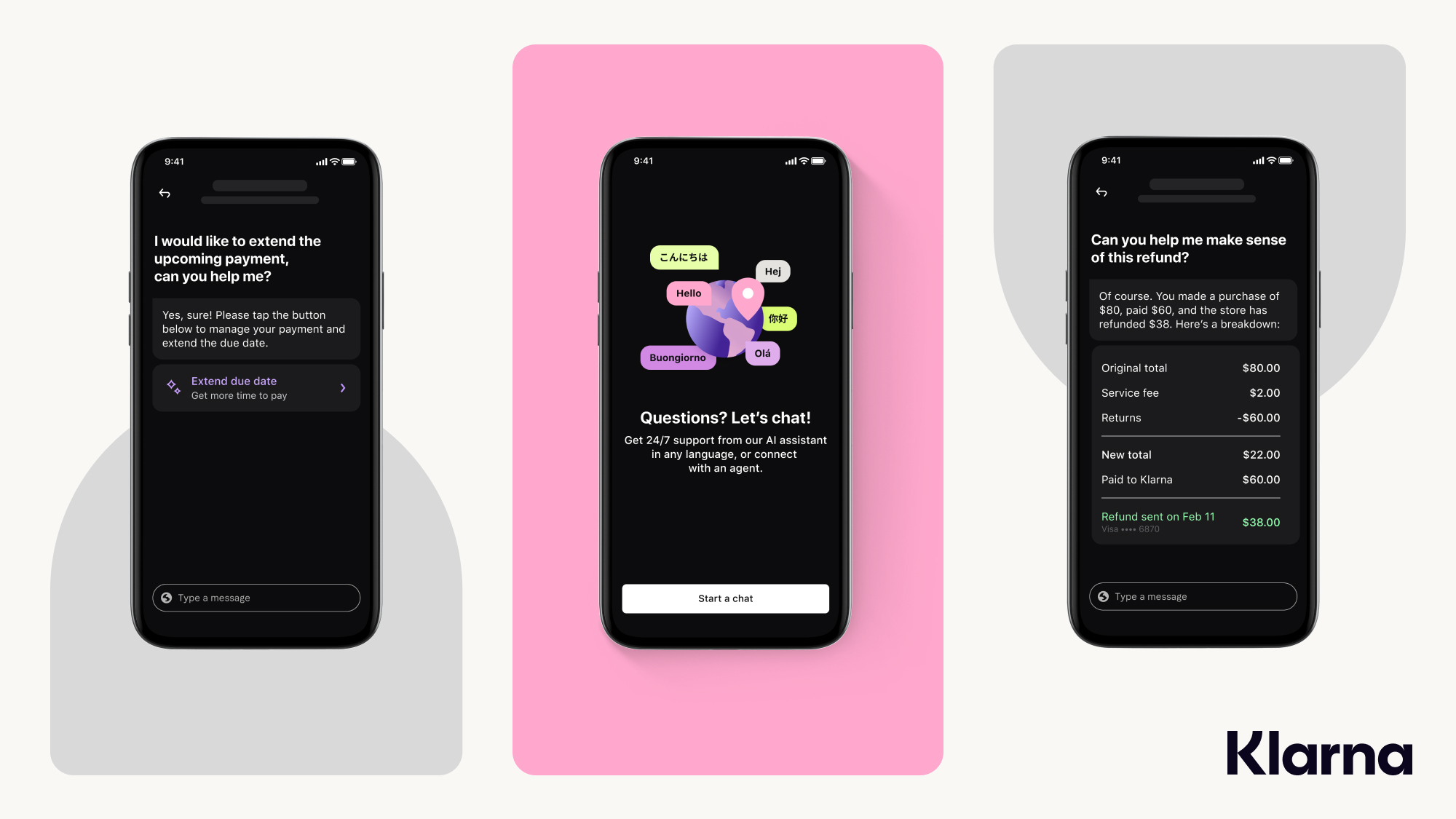

Klarnas AI assistant, operating independently during its inaugural month, is capable of autonomously managing nearly 70% of customer requests, effectively performing tasks equivalent to those carried out by 700 full-time agents.

Following a successful 4-week pilot period, the Klarna AI Assistant, fueled by OpenAIs ChatGPT, has been launched globally.

Furthermore, notable insights and data from this deployment include:

- The AI assistant achieves comparable levels of customer satisfaction to human agents.

- Its precision in resolving tasks results in a significant 25% reduction in repeat inquiries.

- The AI assistant has had 2.3 million conversations, two-thirds of Klarnas customer service chats

- It is doing the equivalent work of 700 full-time agents

- It is on par with human agents in regard to customer satisfaction score

- Customers now resolve their errands in less than 2 mins compared to 11 mins previously

- Its available in 23 markets, 24/7 and communicates in more than 35 languages

- Its estimated to drive a $40 million USD in profit improvement to Klarna in 2024

About ECEBiS

At ECEBiS you are going to understand what will change the trajectory of the financial industry. You will develop a transversal view on the forces that are shaping the future financial industry.

From payments and lending to investment and money management, tech providers are actively shaping the future of the financial landscape - even pushing the boundaries of currency itself. You might evaluate the impact of robo-advising on health management and examine portfolio recommendations from a diversified set of RAs and attempt to identify the factors behind proposed splits between asset classes.

ECEBiS is a platform in academic research on new business models and innovative products. We investigate in fast moving sectors that are reshaping the financial world of tomorrow and pioneering new ways of doing business. We want to attract outstanding ECEBiS students in finance with experiences and exposures, who intend to

Doctorate of Business Administration (DBA) in Finance (online, 3 years part-time)

develop knowledge on challenges that shape the future of financial industry

engage with a program that offers the convenience of online learning with the benefits of accreditation and global reach.

raise awareness on the importance of fintech and sustainability in finance

identify the best practices in the financial industry to spread positive changes

Go beyond the virtual classroom and network with other ambitious executives and entrepreneurs as you expand your credibility and expertise in the world’s most transformative fields.