Agentic AI in Finance: Towards Autonomy, Innovation, and Inclusion (08.04.2025)

As generative AI (GenAI) reshapes industries, the financial sector is now setting its sights on the next frontier—Agentic AI. Unlike GenAI, which requires direct human input, Agentic AI empowers autonomous agents to reason, collaborate, and make decisions independently. This shift promises a future where financial systems are not only faster and smarter but also more human-like in their ability to adapt, personalize, and self-improve. In this article we explore how Agentic AI is poised to revolutionize financial services—from real-time trading and adaptive asset management to personalized financial coaching and micro-loans in underserved regions. Alongside these breakthroughs, however, lie challenges that require thoughtful regulation, human oversight, and collaborative governance.

✨Get a Dissertation Research Proposal on this Topic

Fill in the form and we will shortly create and send you the research proposal on "Agentic AI in Finance: Towards Autonomy, Innovation, and Inclusion " for free.

Agentic AI: The Human-Like Evolution of Automation

Agentic AI represents a fundamental evolution in artificial intelligence. Enabled by advances in transformer-based models and multi-modal learning, Agentic AI allows independent AI agents to plan, reason, reflect, and adapt—much like teams of human experts. These agents go beyond the one-and-done logic of GenAI, learning from feedback and refining their decision-making over time.

Where GenAI answers questions when asked, Agentic AI asks its own questions, sets goals, and coordinates tasks to solve complex problems—enabling a more autonomous and proactive approach to intelligence.

Finance Meets Agentic AI: A Paradigm Shift

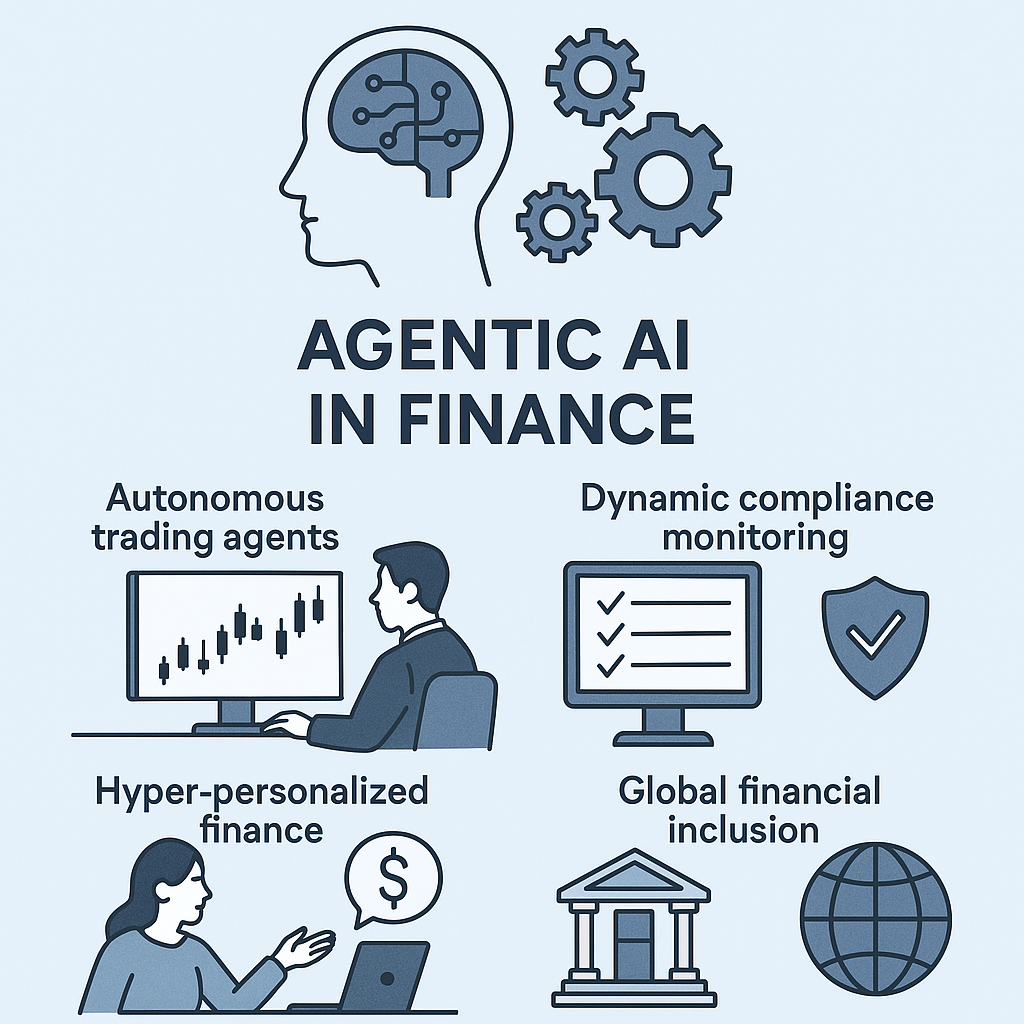

In financial services, Agentic AI opens up exciting use cases:

- Autonomous Trading Agents: These can analyze vast data streams, adjust strategies on-the-fly, and respond to emerging risks in real-time—all without human intervention.

- Dynamic Compliance Monitoring: AI agents can continuously evaluate transactions and behaviours, adapting risk assessments to ever-evolving regulatory and market environments.

- Hyper-Personalized Finance: Instead of passive dashboards, consumers could have interactive, always-on financial advisors tailored to their unique goals and spending habits.

- Process Autonomy: From back-office automation to customer onboarding, Agentic AI could manage repetitive workflows and exceptions more intelligently than rule-based systems.

These innovations signal a shift toward process autonomy in finance—where systems not only complete tasks but learn, adapt, and evolve continuously.

Transforming Customer Experience and Operational Efficiency

The advantages of Agentic AI reach beyond speed and efficiency:

- Operational Streamlining: Tasks like compliance checks, transaction matching, and risk monitoring can be fully automated, reducing costs and human error.

- Adaptive Product Development: New financial tools—such as self-adjusting investment portfolios—can respond to changes in real-time and evolve with market trends.

- Empowered Consumers: Agentic AI can power digital agents that manage budgets, forecast future spending, and optimize financial decisions, giving users greater control over their finances.

As financial tools become more agent-driven and personalized, they move closer to human-like interaction and anticipation—turning digital banking from reactive to proactive.

Challenges and Ethical Considerations

Despite the opportunities, Agentic AI raises significant risks:

- Job Displacement: Roles in compliance, auditing, and asset management may be impacted, requiring new upskilling and workforce adaptation strategies.

- Oversight and Accountability: A "human above the loop" approach remains crucial to ensure that AI decisions are auditable, fair, and aligned with institutional goals.

- Cybersecurity and Privacy: Autonomous systems accessing sensitive data could introduce new attack surfaces and raise privacy concerns.

- Market Volatility: The synchronized behavior of AI-driven agents may lead to unintended consequences, such as flash crashes or systemic instability.

- Explainability: As decision-making becomes more complex, stakeholders must understand how and why AI agents arrive at certain conclusions—especially in high-stakes areas like credit and risk.

Policymakers are beginning to respond. The European Union’s AI Act and the IMF’s automation tax proposal both point to the need for clearer rules, transparency, and ethical standards to guide AI’s integration into finance.

Agentic AI and Global Financial Inclusion

Agentic AI also holds profound potential for emerging economies. By automating complex tasks using local data, it could:

- Assess micro-loans for smallholder farmers without requiring a human loan officer

- Deliver real-time micro-insurance products tied to environmental data

- Enable "AI leapfrogging" by bypassing traditional infrastructure and connecting communities to advanced financial tools directly.

However, power asymmetries in AI access threaten to limit these benefits to a few. Most large-scale AI resources are still concentrated in the Global North, risking market concentration and exclusion. Strong governance frameworks are essential to ensure Agentic AI supports—not undermines—financial inclusion.

Summary: A New Financial Future

Agentic AI is more than just the next step in automation—it is the emergence of intelligent systems that can work, reason, and adapt like humans. For financial services, this means faster decisions, smarter tools, and deeper personalization. From high-frequency trading to rural banking, the possibilities are transformative.

Still, the path forward is not without its risks. Labor shifts, privacy challenges, and systemic stability all require serious attention. Thoughtful regulation, international collaboration, and a firm commitment to responsible AI will be key to ensuring Agentic AI helps build a financial system that is not only efficient but also inclusive and just.

As we move into this new era, one thing is clear: the finance sector is not just adopting AI—it is evolving with it.

About ECEBiS

At ECEBiS you are going to understand what will change the trajectory of the financial industry. You will develop a transversal view on the forces that are shaping the future financial industry.

From payments and lending to investment and money management, tech providers are actively shaping the future of the financial landscape - even pushing the boundaries of currency itself. You might evaluate the impact of robo-advising on health management and examine portfolio recommendations from a diversified set of RAs and attempt to identify the factors behind proposed splits between asset classes.

ECEBiS is a platform in academic research on new business models and innovative products. We investigate in fast moving sectors that are reshaping the financial world of tomorrow and pioneering new ways of doing business. We want to attract outstanding ECEBiS students in finance with experiences and exposures, who intend to

Doctorate of Business Administration (DBA) in Finance (online, 3 years part-time)

develop knowledge on challenges that shape the future of financial industry

engage with a program that offers the convenience of online learning with the benefits of accreditation and global reach.

raise awareness on the importance of fintech and sustainability in finance

identify the best practices in the financial industry to spread positive changes

Go beyond the virtual classroom and network with other ambitious executives and entrepreneurs as you expand your credibility and expertise in the world’s most transformative fields.