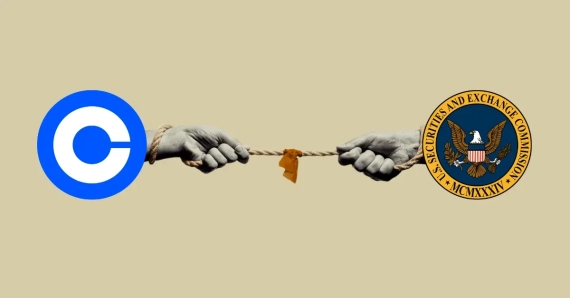

SEC wins ruling allowing a lawsuit against Coinbase (05/2024)

A federal judge has dealt a significant blow to Coinbase, ruling that the U.S. Securities and Exchange Commission (SEC) can proceed with its lawsuit accusing the cryptocurrency exchange of operating as an unregistered broker, exchange, and clearing agency.

✨Get a Dissertation Research Proposal on this Topic

Fill in the form and we will shortly create and send you the research proposal on "SEC wins ruling allowing a lawsuit against Coinbase " for free.

U.S. District Judge Katherine Polk Failla determined that the SEC sufficiently argued its case, particularly regarding Coinbases staking program, which the agency contends involves the unregistered offer and sale of securities.

Despite Coinbases arguments that existing securities laws are ill-suited for the crypto industry, Judge Failla maintained the stance that the challenged transactions align with the framework courts have used to identify securities for nearly 80 years. The judge did, however, dismiss the SECs claim that Coinbase Wallet functions as an unregistered broker.

In response to the ruling, Coinbase Chief Legal Officer Paul Grewal expressed a lack of surprise, noting that early motions against government agencies are often denied. Grewal emphasized that clarity remains the ultimate goal and that the decision keeps Coinbase on that path. He also called for Congress to advance comprehensive digital assets legislation in the U.S., deeming it critical for fostering domestic innovation.

The courts decision marks a significant development in the ongoing legal battle between Coinbase and the SEC, which initially filed the lawsuit in June 2023. The case has drawn attention to the regulatory challenges faced by the crypto industry and the debate over how best to oversee digital assets.

For Coinbase, the ruling presents a setback but not a definitive end to its legal fight. The company is likely to continue challenging the SECs allegations and may pursue necessary appeals. However, the decision does put pressure on Coinbase to reevaluate certain aspects of its business model, particularly its staking program, which has been a focal point of the SECs complaint. Looking at the big picture, the outcome of this case could have far-reaching implications for the wider crypto industry. A Coinbase victory could set a precedent that limits the SECs authority over certain crypto activities, while a loss could embolden the agency to take a more aggressive stance toward other crypto exchanges and platforms. Zooming out, as the lawsuit progresses, the crypto community will be closely watching for further developments and their potential impact on the regulatory landscape. In the meantime, Coinbase will need to navigate the legal challenges while continuing to operate its business and serve its customers. The companys ability to adapt and evolve in the face of regulatory scrutiny will be crucial to its long-term success in the rapidly evolving world of cryptocurrencies.

About ECEBiS

At ECEBiS you are going to understand what will change the trajectory of the financial industry. You will develop a transversal view on the forces that are shaping the future financial industry.

From payments and lending to investment and money management, tech providers are actively shaping the future of the financial landscape - even pushing the boundaries of currency itself. You might evaluate the impact of robo-advising on health management and examine portfolio recommendations from a diversified set of RAs and attempt to identify the factors behind proposed splits between asset classes.

ECEBiS is a platform in academic research on new business models and innovative products. We investigate in fast moving sectors that are reshaping the financial world of tomorrow and pioneering new ways of doing business. We want to attract outstanding ECEBiS students in finance with experiences and exposures, who intend to

Doctorate of Business Administration (DBA) in Finance (online, 3 years part-time)

develop knowledge on challenges that shape the future of financial industry

engage with a program that offers the convenience of online learning with the benefits of accreditation and global reach.

raise awareness on the importance of fintech and sustainability in finance

identify the best practices in the financial industry to spread positive changes

Go beyond the virtual classroom and network with other ambitious executives and entrepreneurs as you expand your credibility and expertise in the world’s most transformative fields.