Format

100% Online

Intakes

5 Times / Year

Faculty

Selected staff from the world's top Business Schools

3 Years Part-Time

Study at your own Pace

Faculty from the Best Business Schools in the World

Advance Your Expertise in Critical Fields

Finance Innovations & Markets

Identify the strengths, risks, and weaknesses of technological innovations in the financial market. Model regional and global financial activities, behaviors, events, and their impact and risk. Forecast the consequences of cross-market, digital financial products.

Government Control, Taxation, & Regulation

Fintech and the digital transformation of financial services: determine and analyze implications for market structure and public policy.

Blockchain, New Monies & Crypto Economy

Tail dependences between new monies and green financial assets. Quantify the hedge and safe- haven properties of bond markets for cryptocurrency indices. Understand the integration of banks and cryptocurrency in a demonetized world.

Portfolio and Risk Management

Analyze and evaluate how research digitization will be the next advantage in the financial markets. Evaluate the current developments of AI in Finance. Understand how FinTech impacts portfolio risk management.

Sustainable investing

Identify the environmental factor impact on default rate of sovereign and corporates. Understand how asset management companies can adopt sustainable investing into their fund management routine. Create a taxonomy based on common investment process. Provide a unique prospective to how ESG can be integrated into asset allocation.

Corporate Investment

Discuss applications of digital asset pricing, trading, mechanism design, and smart contracts. Create awareness and understanding of novel theories and tools for digital assets and their valuation, risk analysis, and management. Define models for robo-advising.

Fintech (Financial Technology)

Identify FinTech implementations and challenges. Determine and analyze transformations in the banking industry by information technology. Analyze and evaluate prospects and challenges of new banking. Forecast the consequences of cross-market, digital financial products. Evaluate innovations in P2P lending and crowdfunding.

Tokens and NFT

Identify applications of blockchain technology in the finance and banking industry beyond digital currencies. Examine the Interrelatedness of NFTs, DeFi Tokens and Cryptocurrencies.

What our students say

I have been fortunate enough to be selected for the Program for Sustainable Excellence at ECEBiS, which grants me cutting-edge resources to pursue my research. I especially enjoy the quantitative, rigorous teaching and the flexibility of the courses. The Finance DBA is the best investment I have made in years. It is spent on me, and is of great value to my future work in finance.

Tebogo Poo

Head of Accounting and Reporting (AfCDC)

ECEBiS has been more than just a platform — it’s been a launchpad for my growth. Being part of a network that connects students, educators, and industry professionals has expanded my perspective and boosted my confidence. From discovering collaborative opportunities to staying informed about the latest in finance and research, ECEBiS has kept me motivated and forward-focused. I’m proud to be part of a community that truly empowers future leaders in finance.

Bose Mathanjane

Financial Markets Sales Manager at Absa Group.

In order for my career to progress in the path I have chosen, obtaining the DBA is essential. My Doctorate of Business Administration in Finance is broadening my business knowledge horizon, allowing me to learn from industry leaders, and explore and share innovative ways of doing business through collaborative projects.

Franz Hartlieb

Director FTC CAPITAL

After more than 20 years working in managerial roles in the financial industry, earning a Doctorate was always at the back of my mind—but I thought I had no time to spend away in academia. ECEBiS was the perfect solution. With professors from the highest-ranked schools, I can study at my pace and stay ahead of the curve in my decision-making.

Marco Mercanti

CEO Oblyon Finance

The ECEBiS courses and masterclasses are an enriching personal journey. I enjoy the ongoing discussion with thought leaders in my field, which always give me exciting new perspectives on the alternative investments industry.

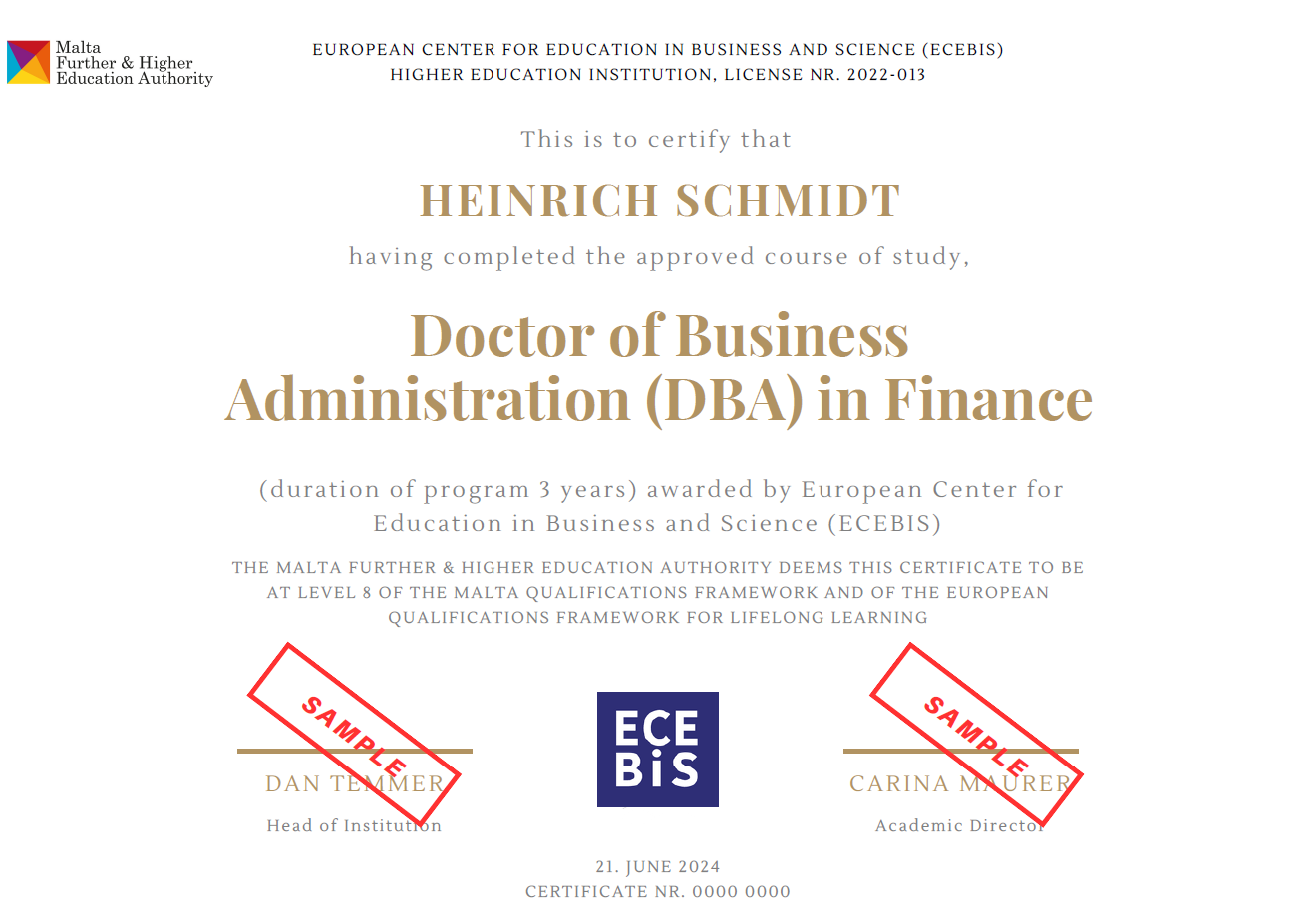

EU accredited Doctoral Program

ECEBiS is accredited by the Malta further and higher education authority (MFHEA). You can find us in the Malta Qualifications Database. The Doctor of Business Administration (DBA) in Finance is accredited as "Higher Education Programme" at MQF/EQF level 8 (Doctoral Degree). You can find more Information at the Malta Qualification Framework and the European Qualification Framework

Curriculum Overview

Financial Management

The objective of this module is to ensure that all students in the course share a common knowledge foundation of Finance concepts, theory, and application in management.

Managerial Economics for Finance

This module is designed for students planning to begin their research project in Finance.

Econometrics for Finance

The module provides the necessary tools and techniques for analyzing and modelling economic and financial data and testing hypothesis about how markets and prices are formed.

Research Methods I - Theory & Analysis

The module explores common research methods in fields like Business, Finance and Economics. Students will refresh their knowledge of the terminology, approaches and tools used to conduct quantitative, qualitative, and mixed methods academic research.

Research Methods II – Design & Application

The main objective of the module is to explore mechanics of research such as the formulation of a research question, choosing an appropriate research strategy and design, formulating, and testing hypotheses, writing a literature review, conducting research incl. data collection, analysis, and the interpretation of results.

Advanced Corporate Finance

The module examines the creation of shareholder value through the investment decisions of the corporate financial manager. The development of optimal corporate financial decisions is explored in three areas: Investments, Financing and Financial Risk Management.

Finance Reading Seminar

The objective of this module is to provide students with an understanding and appreciation of academic writing, debate, and research within their discipline.

Research Skills Seminar

The objective of this seminar-style module is to help guide students through the dissertation writing process and beyond.

Investments and Portfolio Management

This module provides an intensive exploration of investment alternatives including portfolio theory, asset pricing, speculative markets, performance evaluation and the efficiency of markets.

Global Financial Markets and Institutions

This module explores the competitive dynamics and performance of global financial institutions and markets against the backdrop of rapidly changing technologies, introduction of new monies (e.g., Cryptocurrencies), increased globalization, and an evolving regulatory environment.

Fintech

This module explores how recent technological innovations in the finance sector have affected the processes, products, business models and instruments of financial intermediaries.

Dissertation

As a final requirement for program completion, students must complete their dissertation aimed at the investigation of a significant business challenge that is of strategic importance to their own organization, the industry, or the market