A major disruption caused by a Fintech Platform leads to Hundreds of Thousands of Frozen Accounts (28.11.2024)

The fintech platform Synapse, which abruptly froze hundreds of thousands of customer accounts across multiple partner financial institutions, caused a major disruption. Reliance on third-party fintech services for banking operations can lead to widespread financial chaos. The situation highlights the risks and regulatory challenges of outsourcing core banking functions to non-bank intermediaries.

✨Get a Dissertation Research Proposal on this Topic

Fill in the form and we will shortly create and send you the research proposal on "A major disruption caused by a Fintech Platform leads to Hundreds of Thousands of Frozen Accounts " for free.

Synapse’s Operational Meltdown

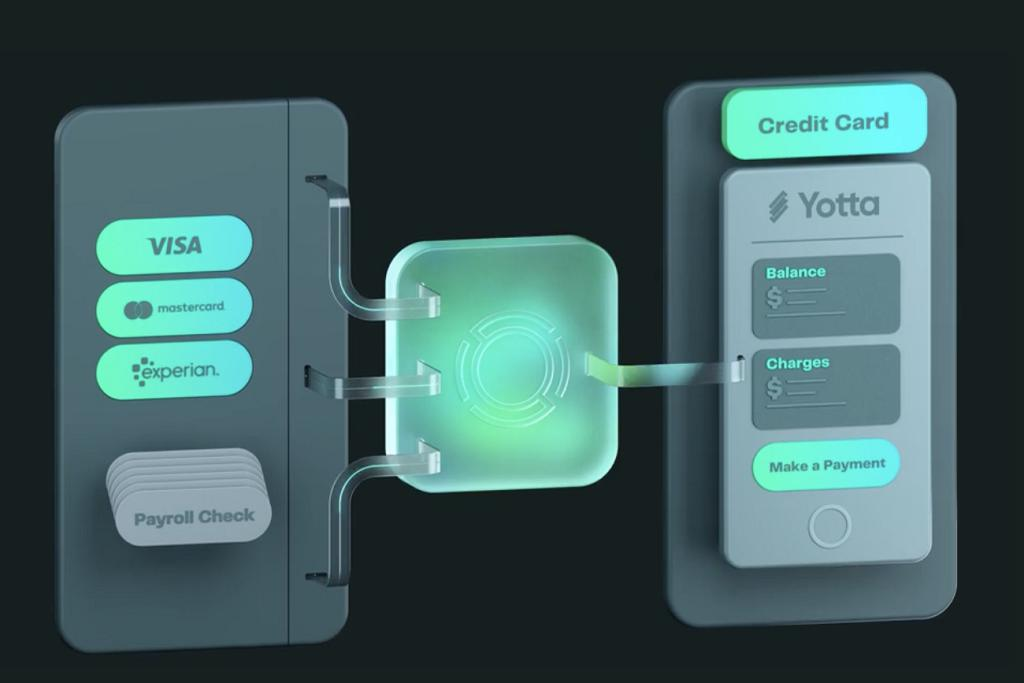

Synapse, founded in 2014, pioneered the "banking-as-a-service" (BaaS) model, enabling startups to offer financial services without the immense costs of obtaining banking charters or infrastructure. Acting as a bridge, it connects fintech firms with sponsor banks, such as Evolve, through pooled "for benefit of" (FBO) accounts. This backend system invisibly manages individual accounts, simplifying operations for startups. Synapse froze accounts due to compliance and operational issues. This affected numerous customers of its partner banks, demonstrating the fragility of fintech-reliant banking ecosystems. The freeze blocked access to essential funds, severely impacting customers.

Regulatory Challenges

The incident underscores a regulatory blind spot. Fintech firms operate under fewer regulations than traditional banks, even when they perform similar functions. This incident exposes the potential dangers of insufficient oversight, particularly concerning consumer protection and financial stability.

Impact on Consumers and Banks

Consumers, especially marginalized groups relying on online-only financial services, bore the brunt of the crisis. Partner banks also faced reputational damage despite outsourcing these services, highlighting the interconnected risks in modern banking systems.

Conclusion

The Synapse situation reveals significant vulnerabilities in the fintech ecosystem, emphasizing the need for tighter regulatory controls and more robust operational safeguards. While fintech offers innovation and accessibility, these benefits should not come at the expense of financial stability and consumer trust.

About ECEBiS

At ECEBiS you are going to understand what will change the trajectory of the financial industry. You will develop a transversal view on the forces that are shaping the future financial industry.

From payments and lending to investment and money management, tech providers are actively shaping the future of the financial landscape - even pushing the boundaries of currency itself. You might evaluate the impact of robo-advising on health management and examine portfolio recommendations from a diversified set of RAs and attempt to identify the factors behind proposed splits between asset classes.

ECEBiS is a platform in academic research on new business models and innovative products. We investigate in fast moving sectors that are reshaping the financial world of tomorrow and pioneering new ways of doing business. We want to attract outstanding ECEBiS students in finance with experiences and exposures, who intend to

Doctorate of Business Administration (DBA) in Finance (online, 3 years part-time)

develop knowledge on challenges that shape the future of financial industry

engage with a program that offers the convenience of online learning with the benefits of accreditation and global reach.

raise awareness on the importance of fintech and sustainability in finance

identify the best practices in the financial industry to spread positive changes

Go beyond the virtual classroom and network with other ambitious executives and entrepreneurs as you expand your credibility and expertise in the world’s most transformative fields.